Candlestick patterns originated in Japan and have been used for centuries to analyse price movements in the rice markets. They gained global recognition in the 1990s and are now widely used by traders in various financial markets, including stocks, forex, and commodities. Forex candlestick patterns provide visual representations of price action, offering insights into market psychology and potential trend reversals.

Candlestick patterns are a valuable tool in forex trading, providing insights into market sentiment and potential price reversals. Traders can use bullish reversal patterns to identify potential buying opportunities. One such pattern is the bullish engulfing candlestick, where a small bearish candle is followed by a larger bullish candle that engulfs it. This pattern suggests a shift in momentum from sellers to buyers, indicating a possible upward trend. By recognizing these patterns, traders can make more informed decisions based on market trends.

Another important candlestick pattern is the shooting star trading, which can indicate a potential reversal in an upward trend. This pattern appears as a small-bodied candle with a long upper wick, resembling a star. The long upper wick indicates that buyers pushed the price up, but sellers regained control by the end of the session, creating a bearish signal.

Conversely, the hammer chart pattern is a bullish reversal pattern that suggests a potential trend reversal from a downtrend to an uptrend. It appears as a small-bodied candle with a long lower wick, resembling a hammer. This pattern indicates that sellers pushed the price down, but buyers regained control, signalling a potential upward movement.

To effectively utilize candlestick patterns in trading, traders should combine them with other technical analysis tools and indicators. By using multiple confirming signals, traders can increase the reliability of their trading decisions. It is important to remember that candlestick patterns are not foolproof and should be used in conjunction with proper risk management strategies.

Additionally, traders should consider the timeframe they are trading on, as candlestick patterns may vary in significance depending on the timeframe. Trading techniques may be improved and chances of success in the forex market increased by properly understanding and utilizing candlestick patterns.

Basic Candlestick Patterns

Bullish Reversal Patterns

Bullish reversal patterns signal a potential trend reversal from bearish to bullish. These patterns often occur at the end of a downtrend and indicate a shift in market sentiment. Some common bullish reversal patterns include:

Hammer:

The hammer pattern has a small body with a long lower shadow and little to no upper shadow. It suggests that selling pressure has been exhausted, and buyers are stepping in, potentially leading to an upward move.

Bullish Engulfing Pattern:

It signifies a shift from bearish to bullish sentiment as buyers overpower the sellers, potentially indicating a trend reversal.

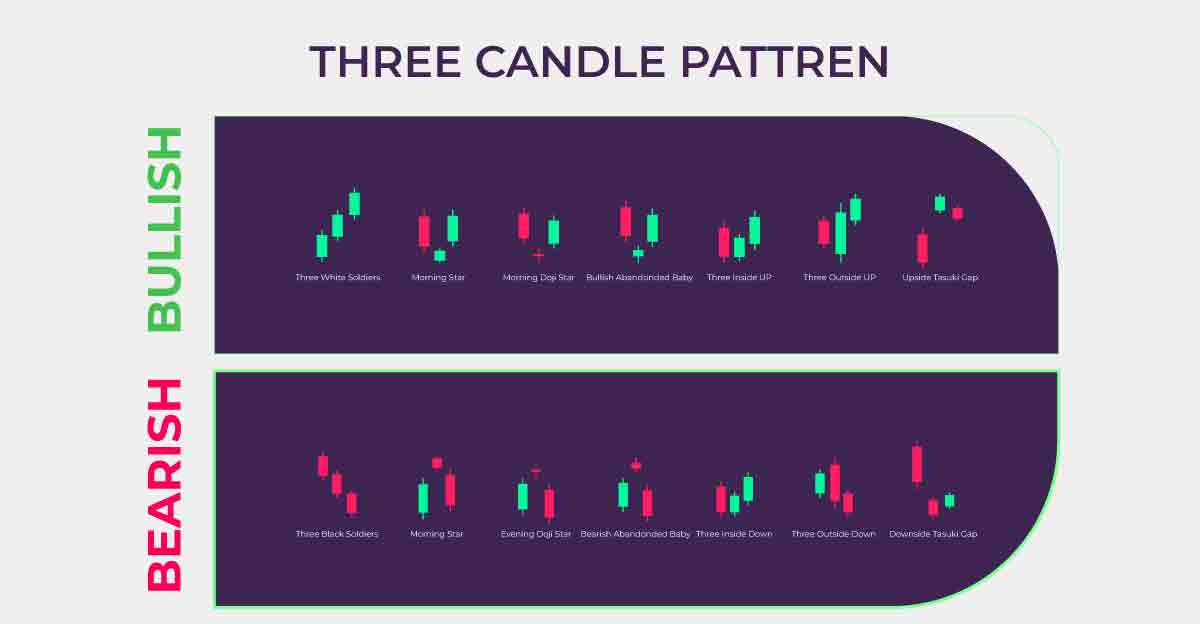

Morning Star:

The morning star pattern is a three-candle pattern that appears at the end of a downtrend. It starts with a large bearish candle, followed by a small candle with a smaller range, indicating indecision. Finally, a large bullish candle forms, signaling a potential reversal as buyers take control.

Double Bottom:

The double bottom pattern is a chart pattern that forms when the price reaches a low, bounces back, and then declines again to a similar or slightly higher level before reversing upward. It suggests a strong support level and indicates that buyers are stepping in, potentially leading to an uptrend.

Bearish Reversal Patterns

Bearish reversal patterns indicate a potential trend reversal from bullish to bearish. These patterns often occur at the end of an uptrend and can help traders identify potential selling opportunities. Some common bearish reversal patterns include:

Shooting Star:

The shooting star pattern has a small body with a long upper shadow and little to no lower shadow. It suggests that buyers were initially in control but lost momentum, indicating a possible trend reversal.

Bearish Engulfing Pattern:

When a little bullish candle is followed by a larger bearish candle that engulfs the first candle, this pattern is formed. It signifies a shift from bullish to bearish sentiment as sellers overpower the buyers, potentially indicating a trend reversal.

Evening Star:

The evening star pattern is a three-candle pattern that appears at the end of an uptrend. It starts with a large bullish candle, followed by a small candle with a smaller range, indicating indecision. Finally, a large bearish candle forms, signaling a potential reversal as sellers take control.

Double Top:

The double top pattern is a chart pattern that forms when the price reaches a high, pulls back, and then rises again to a similar or slightly lower level before reversing downward. It suggests a strong resistance level and indicates that sellers are stepping in, potentially leading to a downtrend.

Continuation Patterns

They provide valuable information to traders looking to capitalize on the continuation of the trend. Some common continuation patterns include:

Flag Pattern:

The flag pattern forms when the price experiences a sharp and quick move in one direction (the flagpole) followed by a period of consolidation in the form of parallel trendlines (the flag). This pattern suggests a temporary pause before the prevailing trend resumes.

Pennant Pattern:

Similar to the flag pattern, the pennant pattern also represents a brief consolidation phase. However, in this pattern, the consolidation is characterized by converging trendlines, forming a triangular shape. The pennant pattern signals a continuation of the previous trend once the price breaks out of the pattern.

Ascending Triangle:

The ascending triangle pattern forms when the price makes higher swing lows and encounters resistance at a horizontal trendline. This pattern suggests that buyers are becoming increasingly aggressive, and a breakout above the resistance level may indicate a continuation of the upward trend.

Advanced Candlestick Patterns

Bullish Engulfing Candlestick Pattern

When a small bearish candle is followed by a larger bullish candle that engulfs the prior candle, a strong bullish reversal pattern known as the bullish engulfing pattern develops. This pattern suggests a shift in market sentiment from bearish to bullish and provides a potential buying opportunity.

Bearish Engulfing Candlestick Pattern

In direct contrast to the bullish engulfing pattern is the bearish engulfing pattern. It happens when a small bearish candle immediately follows a larger bullish candle, engulfing the first candle. This pattern indicates a potential shift in market sentiment from bullish to bearish and can be used as a signal to sell or short an asset.

Shooting Star Candlestick Pattern

The shooting star pattern is a bearish reversal pattern that forms when a candle has a small body and a long upper shadow, with little to no lower shadow. It suggests that buyers initially had control but lost momentum, and sellers are likely to take over, potentially leading to a price decline.

Hammer Candlestick Pattern

A bullish reversal pattern with a short body, a big lower shadow, and little to no upper shadow is known as a hammer pattern. It indicates that selling pressure has been exhausted, and buyers are stepping in, potentially leading to an upward move.

Doji Candlestick Pattern:

The doji pattern occurs when the opening and closing prices of a candle are very close or virtually the same, resulting in a small or non-existent body. It indicates a state of market indecision, where buyers and sellers are in equilibrium. A Doji can signal a potential trend reversal or a continuation, depending on the context and confirmation from other indicators.

Evening Star Candlestick Pattern

The evening star pattern is a bearish reversal pattern that consists of three candles. It begins with a large bullish candle, followed by a small candle indicating indecision. Finally, a large bearish candle forms, suggesting a potential reversal as sellers take control. It often occurs at the end of an uptrend and can be a strong signal to consider selling or shorting.

Using Candlestick Patterns in Trading

To effectively use candlestick patterns in trading, it is essential to combine them with other technical analysis tools and indicators.

Confirmation:

Always look for confirmation from other indicators or patterns before making a trading decision based solely on a candlestick pattern.

Multiple Timeframes:

Analyze candlestick patterns on multiple timeframes to gain a broader perspective of market sentiment.

Risk Management:

Implement proper risk management strategies to protect your capital in case the trade doesn't go as planned.

Backtesting:

Test the effectiveness of candlestick patterns by backtesting them on historical price data.

Common Mistakes to Avoid

When using candlestick patterns for trading, it's crucial to avoid some common mistakes that can lead to poor decision-making.

When it comes to using candlestick patterns for trading, one common mistake is overtrading. Some traders get excited by every candlestick pattern they see and feel the need to enter a trade immediately. However, not all candlestick patterns are reliable or offer high-probability setups. It's important to exercise patience and only trade when you have a clear and strong signal. For example, if you see a bullish engulfing pattern in an uptrend with strong volume and other confirming indicators, it may indicate a high probability setup. But if the same pattern appears in a range-bound market with low volume, it may not be as reliable.

Ignoring the overall trend is another mistake to avoid. Candlestick patterns should be analyzed within the context of the broader market trend. For instance, if the overall trend is bearish and you spot a bullish hammer pattern, it may not be a strong reversal signal. It's important to consider the direction of the trend and look for candlestick patterns that align with it. This increases the probability of your trades being successful.

Neglecting risk management is a crucial mistake that can lead to significant losses. Even if you correctly identify a candlestick pattern, it doesn't guarantee a profitable trade. Proper risk management techniques, such as setting stop-loss orders and determining position sizes, are essential to protect your trading capital. For example, A stop-loss order should be placed above the shooting star's high if you decide to trade based on a bearish shooting star pattern to reduce possible losses if the market goes against you.

Relying solely on candlestick patterns without confirming indicators is another common mistake. While candlestick patterns provide valuable insights, they should be used in conjunction with other technical indicators to validate trade signals. For instance, if you identify a bullish engulfing pattern, you can further confirm the signal by looking at the volume, moving averages, or support and resistance levels. By combining multiple indicators, you can increase the reliability of your trading decisions and reduce the chances of false signals.

Conclusion:

Candlestick patterns are powerful tools that can provide valuable insights into market sentiment and potential trend reversals. By learning to identify and interpret these patterns, traders can make more informed trading decisions. However, it's crucial to remember that no indicator or pattern guarantees success in trading. Always combine candlestick patterns with other technical analysis tools and develop a robust trading strategy based on thorough research and analysis.